Mapping the Environmental Impact of Blockchain Mining

Published

January 2025

Author

Freya Tan.

Despite the transformative promise of decentralized finance, the environmental externalities of blockchain—

especially under Proof-of-Work (PoW)—are profound and complex. Serious policy and investment decisions

require moving past anecdotal outrage to a structured, empirical assessment of impact.

In this article, I synthesize the current research and data to map five major dimensions of blockchain mining’s ecological footprint, each of which has become a policy and engineering challenge in its own right. Only by confronting these facets together can we craft credible and sustainable digital infrastructure.

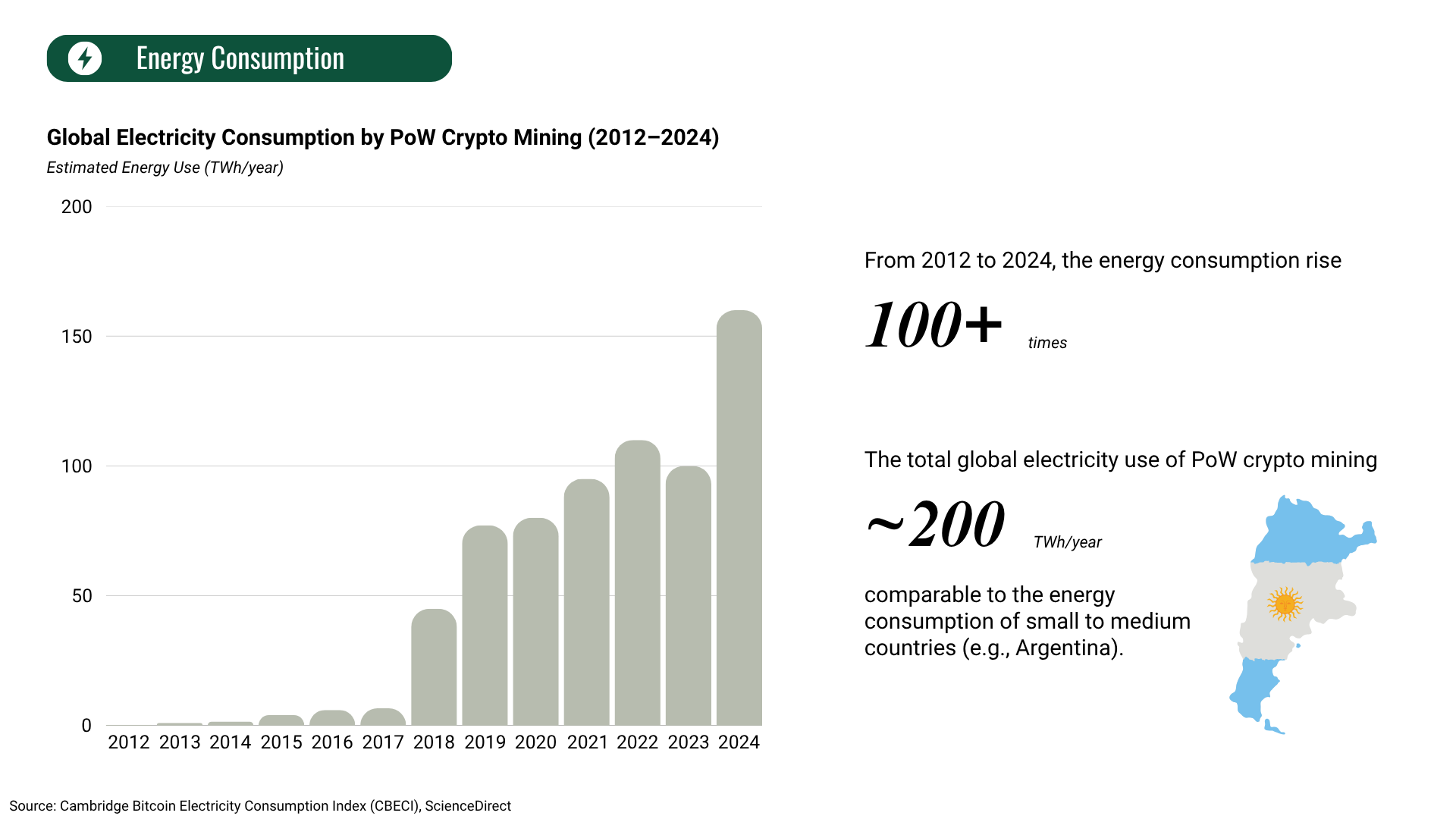

1. Electricity Consumption

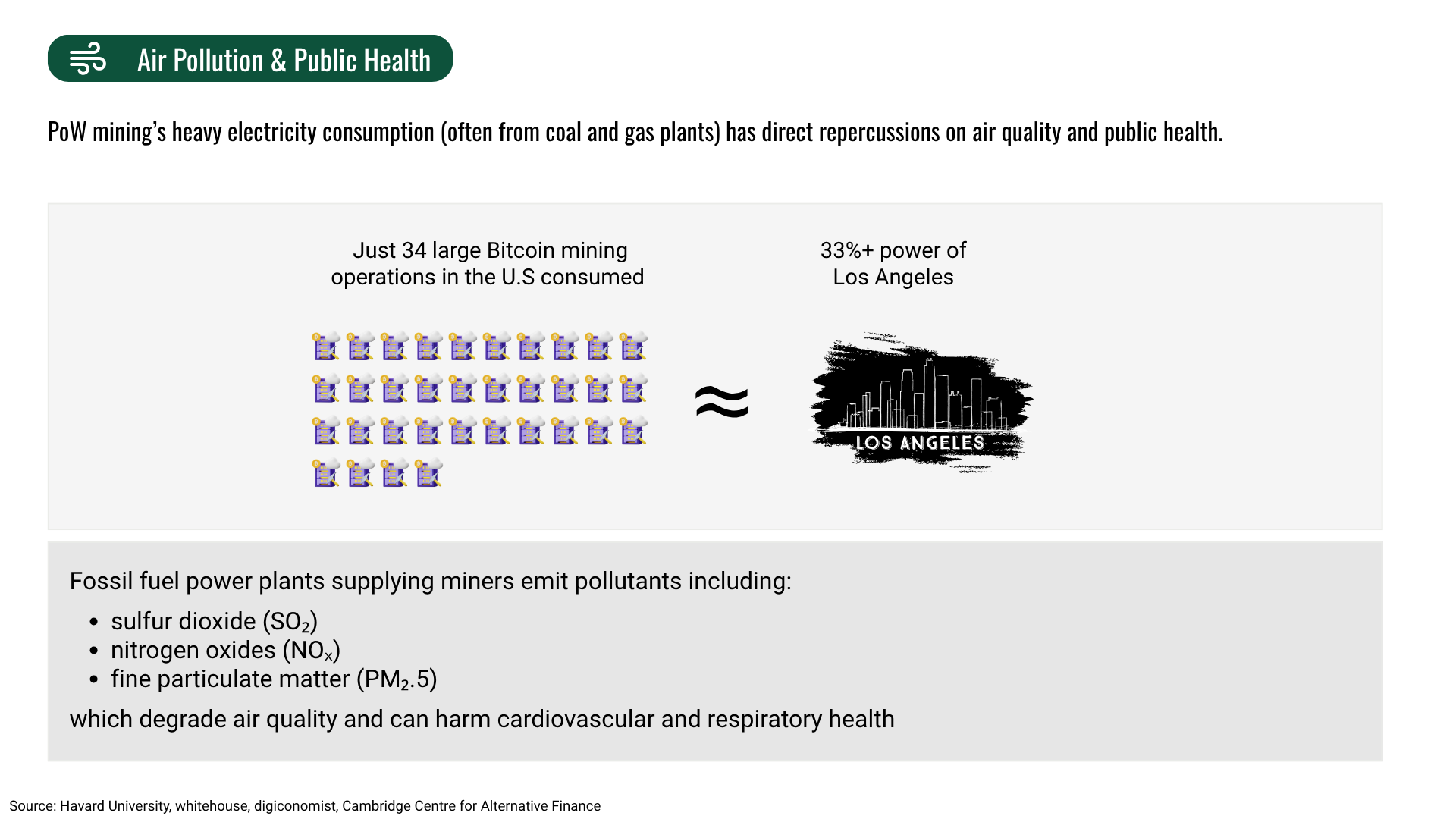

Mining networks are designed to maximize security through resource expenditure, which in PoW translates directly to relentless electricity use. The “arms race” logic of PoW makes energy consumption endogenous and market-driven: as asset prices rise, more miners join, pushing total power draw higher.

What is often missed in mainstream commentary is that this consumption is both elastic and borderless. Bitcoin’s aggregate draw frequently rivals mid-sized nations—not because of inefficiency per se, but because its protocol turns energy into a form of economic trust. For system designers, the key technical question is whether such “energy-backed security” is worth the external costs, or whether alternatives can achieve equivalent robustness with far less input.

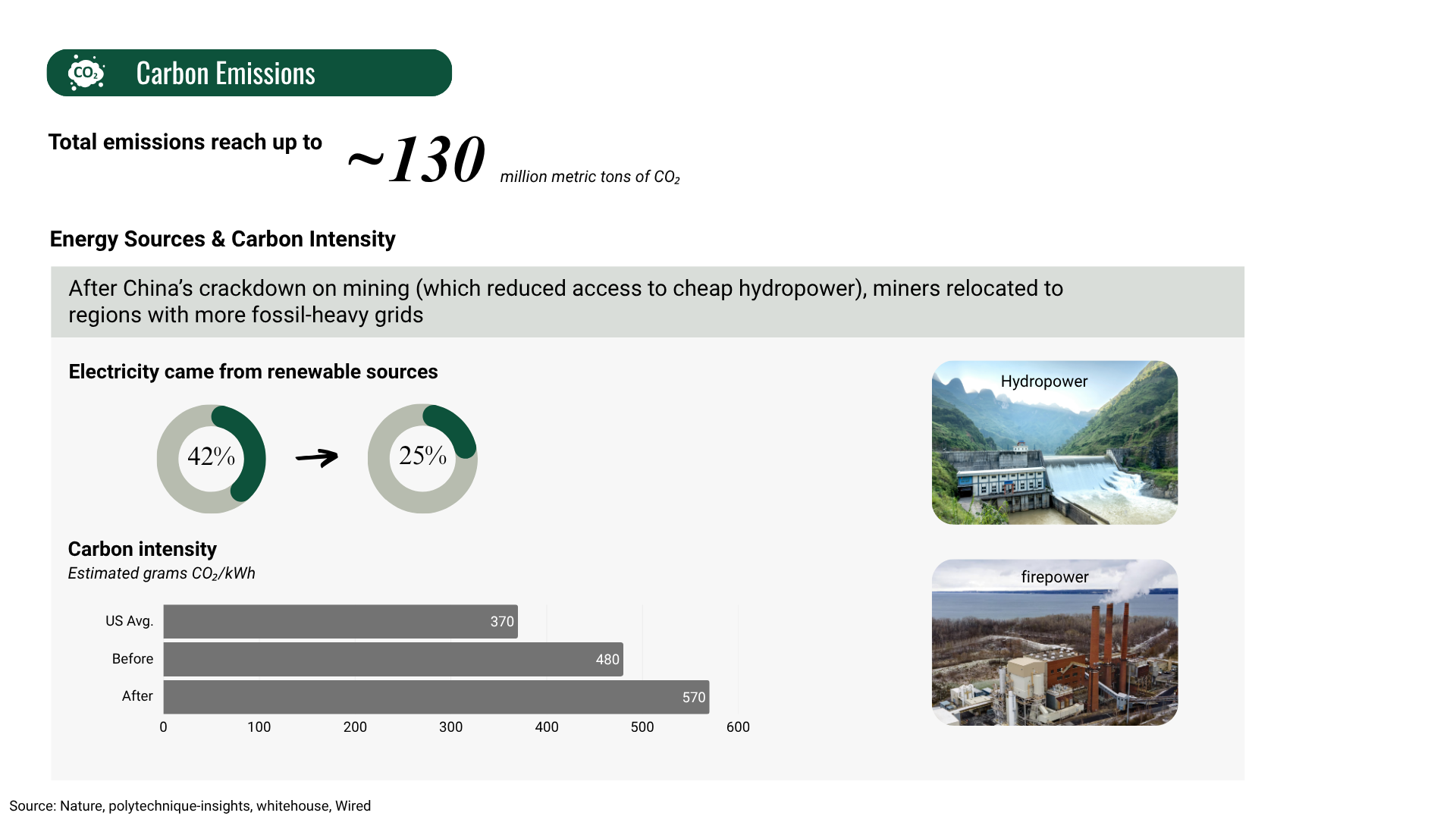

2. Carbon Emissions

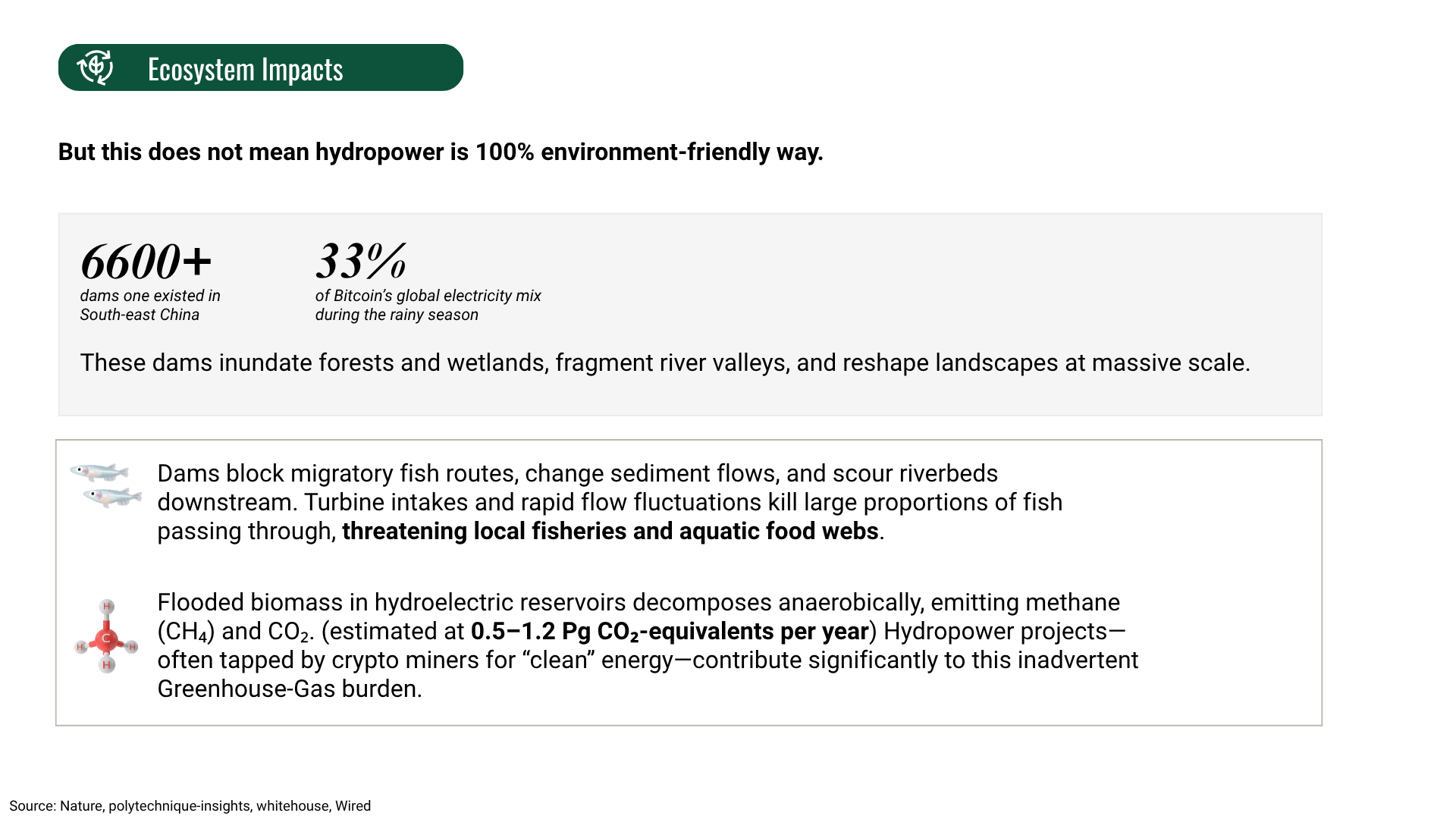

The environmental severity of mining is a function of not just how much energy is used, but what kind. Carbon intensity, measured in grams of CO₂ per kWh, becomes the critical variable. As miners chase low-cost electricity, they often end up in regions with poor carbon efficiency—typically where regulation is lax or grid infrastructure is outdated.

A more sophisticated view recognizes that “renewable arbitrage” (seeking cheap hydropower or stranded renewables) can mitigate climate impact—but only temporarily and with unintended consequences. The 2021 Chinese mining exodus shifted much of the hash rate to Kazakhstan and the American Midwest, both coal-heavy. This map-based visualization is not just a snapshot, but a warning: absent coordinated standards, global emission footprints can worsen even as local improvements are made.

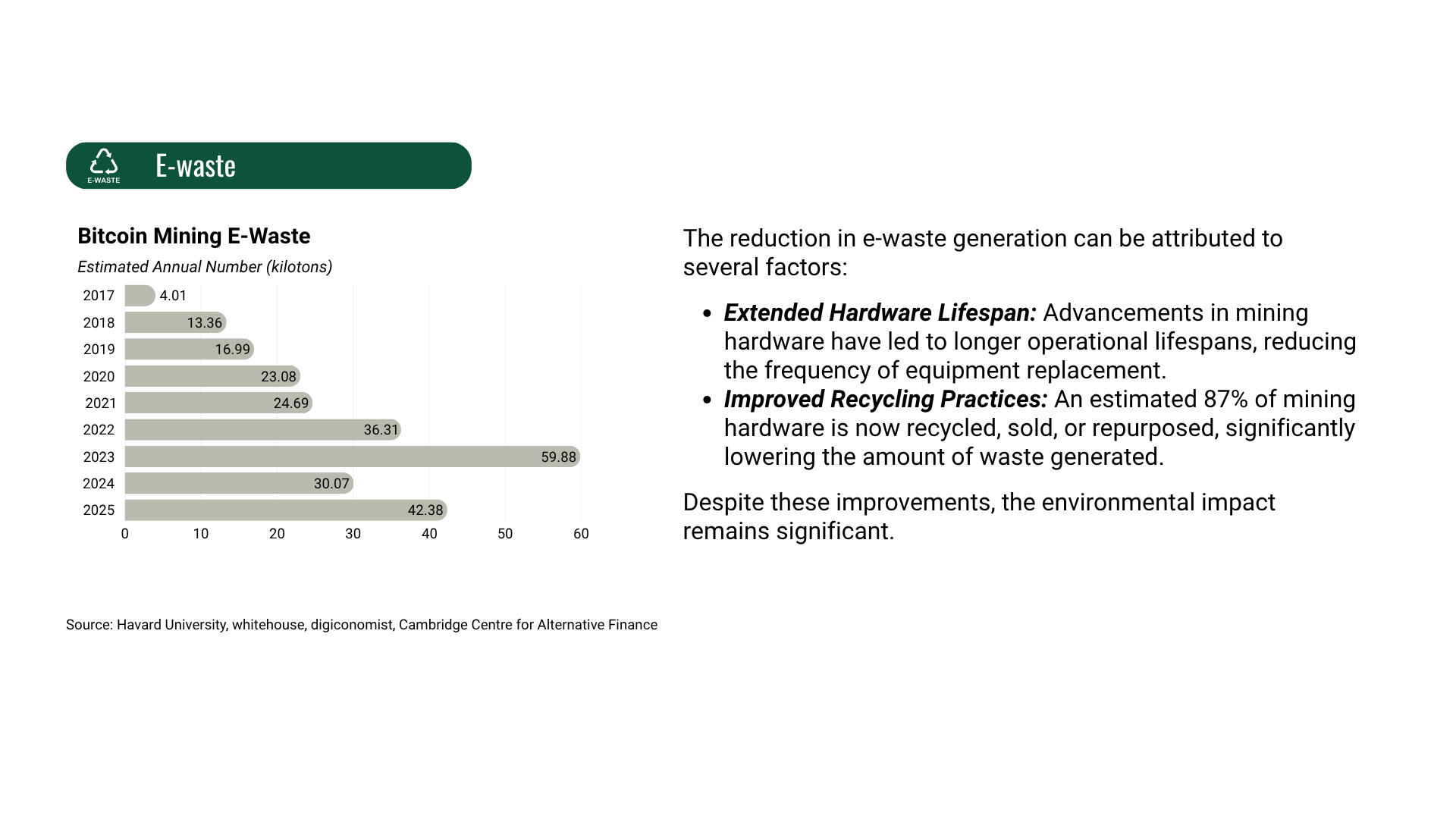

3. Electronic Waste (E-Waste)

While energy and emissions have captured headlines, mining’s e-waste impact is only beginning to be understood. ASIC miners are engineered for single-purpose performance and quickly become obsolete as difficulty rises and chips advance. This accelerated turnover—measured in thousands of tons of e-waste annually—outpaces even the smartphone sector in per-device obsolescence.

Few, if any, global standards exist for the responsible recycling or disposal of mining hardware. Unlike data center servers, ASICs are difficult to repurpose and are rarely recycled for component value. This has implications for resource extraction, environmental justice, and for the lifecycle cost model of digital infrastructure.

4. Water Usage and Heat Emissions

Mining hardware generates massive heat loads. Many facilities rely on evaporative or direct water cooling, especially where energy prices are low but air temperature or humidity are not ideal. The externalities here are both direct (local water usage, thermal pollution of rivers and aquifers) and indirect (infrastructure wear, microclimate impacts).

As climate volatility increases, the competition for water between agriculture, cities, and industry will only intensify. Blockchain’s cooling needs may seem minor compared to steel or semiconductors, but their distribution—often in remote or resource-constrained regions—amplifies local risk.

5. Land Use and Geopolitical Spillovers

Mining operations can reshape regional development, alter land markets, and sometimes strain relations with local communities and utilities. The transnational character of mining makes local interventions vulnerable to “leakage” effects, where policy in one jurisdiction simply displaces externalities elsewhere.

The shifting geography of hash rate, particularly after major regulatory shocks (e.g., China’s 2021 ban), has demonstrated that blockchain is not only a technical system, but also a geopolitical actor. For global governance, this requires new models of international coordination.

Conclusion

Mapping the environmental footprint of blockchain mining reveals a multi-dimensional challenge at the intersection of technology, economics, and governance. These five domains—electricity, carbon, hardware waste, water, and land—are not independent, but mutually reinforcing. The data and visualizations in this report underline the necessity for holistic, adaptive regulatory frameworks and for protocol design that accounts for physical-world impacts.

As blockchain evolves, environmental accountability will determine not only social license to operate, but also the long-term resilience and legitimacy of decentralized finance. Sustainable innovation will require moving past zero-sum trade-offs toward integrated solutions—grounded in rigorous empirical mapping and cross-sectoral collaboration.